Contentions of the Indian Tax Authorities:

- The issue has to be decided in terms of the provisions of the IT Act, 1961 and under Indo-US DTAA and not under the Indian Copyright Act. Reference to Indian Copyright Act 1957 should be made for the limited purpose of finding out meaning of the word copyright.

- The term copyrighted article has neither been defined under ITA nor in Indian Copyright Act. As recognized in the Income Tax Act as also under the Copyright Act, there are basic differences between a book or music CD and a computer programme. Thus the term copyrighted article may be aptly used for a book or music CD but it is a misnomer in the case of computer programme (software) where one or more rights in copyright have necessarily to be transferred to make it workable.

- The nomenclature given to transaction is not decisive of the nature of transaction. Whether the same is called copyrighted article or copyright, it makes no difference so long as consideration paid is in respect of exercising the rights in copyright.

The ITA maintains a clear distinction between an article and computer software. The provisions contained in Section 10A provide for deduction of such profits and gains as are derived from the export of articles or things or computer software. The use of the word “computer software” as distinguished from articles or things is clearly suggestive of the fact that computer software is not the same as an article, whether copyrighted or not. The ITA maintains a clear distinction between an article and computer software. The provisions contained in Section 10A provide for deduction of such profits and gains as are derived from the export of articles or things or computer software. The use of the word “computer software” as distinguished from articles or things is clearly suggestive of the fact that computer software is not the same as an article, whether copyrighted or not.- The end user license agreement clearly states that the product is licensed and not sold. There are limitations on the rights granted to licensees as the programme is to be returned or destroyed on expiry of the licence. Hence it cannot be considered as sale.

- Computer software, particularly Microsoft software, also falls within the ambit and scope of an “invention” and a “patent”. MS Software is patented in USA. The software is held to be original invention. The end user license agreement refers that the product is protected by copyright and other intellectual property rights. As held in the case of Microsoft by US courts, some of software may not be computer programmes but may be the original inventions and hence patentable.

- Reliance on the OECD commentary or on the IRS regulations in support of the proposition that it is a sale of a copyrighted article is not valid in view of India’s reservations on the OECD commentary.

- It is submitted that when the language employed in Indo-US DTAA is not ambiguous, any reference to other treaties is wholly unnecessary. In any case, an interpretative inference by reference to comparative analysis of two different agreements is wholly unwarranted in regard to negotiated agreements. In any case, the outcome of negotiation with one country cannot lead to the presumption that similar issue was under negotiation with the other country and a contrary view has finally emerged.

- Thus, going by the peculiar facts of the instant case, there was a definite transfer of rights in a copyright under a license and this would give rise to income from royalty.

Contentions of the Taxpayer:

- The expression “copyright, literary, artistic or scientific work including films” has not been defined under ITA. The same should be read as copyright of literary, artistic or scientific work.

- Since computer software/programme has been granted protection under Indian Copyright Act, 1957, in order to determine the taxability pursuant to sale of computer programme to end user, reliance should be placed only on the Indian Copyright Act, 1957 and not under any other category of intellectual property right laws. Reference can be made to the decision of Bangalore Tribunal in the case of Sonata Software Ltd. to support the view that the computer programme cannot be considered as patent, invention or process2.

- The copyright in the programme may remain with the originator of the programme but the moment, copies are made and marketed, it becomes ‘goods’ which are susceptible to sales tax. There is a difference between copyright and a copyrighted article.

- The consideration received by MRSC/MS Corp from Indian distributors is towards sale of Microsoft software products, being copyrighted articles. The end users have not been granted any right in copyright in such software and therefore, such consideration is not taxable as royalty under section 9(1)(vi) of the Act. Reliance can be placed in this regard on the decision of Delhi Special Bench in the case of Motorola Inc wherein it has been held that if the payment is for copyright, then it is taxable. On the other hand, if the payment is for copyrighted article, then it is mere purchase and cannot be considered as royalty.

- The objective of end user license agreement is to ensure protection against misuse, abuse or piracy of software and is nothing but a set of instructions or conditions, imposed by a copyright holder on an end user of a copyrighted article. It is similar to the restrictions and limitations imposed by a copyright owner in a book published and sold at a time when a buyer buys the book for his use.

- Wherever appropriate, the Government has chosen to incorporate the expression “computer software” specifically in the definition of royalty. For instance, the treaty between India and Kyrgyz Republic during the period from 2001 to 2003 specifically included the term software/computer software programme in the definition of royalty. When the same is conspicuous by its absence, the same cannot be read into treaty by implication.

- There is no use of ‘copyright’ in India by the end user and the transaction in India is in the nature of ‘sale’ of copyrighted Article.

Relevant Issue before Delhi Tribunal:

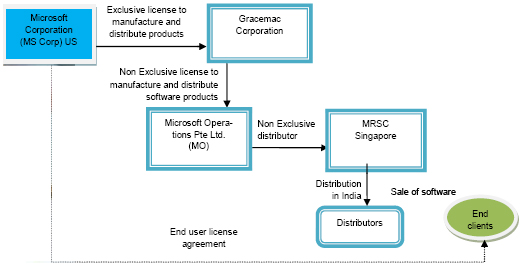

- Whether or not sale of “off the shelf software product” by the US based non resident companies to independent Indian distributors is taxable in the hands of such non resident companies as royalties under Indian Income Tax Act (ITA) as well as under Article 12 of India-US tax treaty?

Ruling of Delhi Tribunal: Ruling of Delhi Tribunal:

- The use of punctuation mark coma (,) after word copyright indicates that legislative intent is to treat word copyright independent of words “literary, artistic or scientific work”. The use of word “of” between copyright and literary would limit the scope of royalty only to copyright work relating to literary, artistic or scientific work. The term “copyright” is wide enough to include other works.

- As per India-US treaty, royalties or fees for included services shall be deemed to arise in the state in which the use or right to use, right or property, or the fees for included services is performed.

- OECD commentary or US IRS regulations would not be safe or acceptable guide/aid to interpret the provisions of Indian ITA or treaty between India or any other country. Therefore, there is no need for importing expression copyrighted article from OECD commentary or US guidelines for the purpose of interpretation of term royalty.

- There is no dispute that Microsoft products are patented in the US. The end user license agreement also specifies that product is protected by copyright and other intellectual property rights. Therefore, the payments made by end users as a consideration for use or right to use of such payments would be in the nature of royalty as covered under ITA and India-US treaty.

- The definition of royalty under ITA covers patent and invention as two different items. Further, the Patent Act defines a patent to mean a patent for any invention granted under the Act. Hence, Microsoft computer programmes are inventions and the payment made for the use or right to use the same would amount to royalty.

- A copy of decision of Delhi High Court granting injunction on a plaint filed by Microsoft against Pawan Jain & others for infringement of copyrights in the software is on records. It is clear that on one hand the taxpayer is contending that products sold to end users are copyrighted articles and do not contain copyright.

On the other hand, under Copyright Act, the taxpayer is enforcing rights stating that the use of unlicensed/pirated copyofsoftware products involves infringement of copyrights. On the other hand, under Copyright Act, the taxpayer is enforcing rights stating that the use of unlicensed/pirated copyofsoftware products involves infringement of copyrights.

- The definition of the term royalty under ITA and India-US treaty is identical.

- Since end users have made payments in respect of granting of license in respect of copyright in computer programmes, the payments made by end users as a consideration for same will be taxable in the hands of Gracemac.

- MSRC has appointed distributors in India. Therefore, MSRC has a business connection in India and the portion of income earned by it could have been chargeable to tax as business income in India. However, since the entire receipts have been taxed as royalties in the hands of Gracemac, the MRSC cannot be taxed again on the same income which had been taxed in the hands of Gracemac.

Our Comments:

It is pertinent to note that the decision of Delhi Tribunal has been pronounced on 26th October 2010. Subsequent to decision of Delhi Tribunal, there is a decision of Mumbai Tribunal pronounced on 29th October 2010 in the case of Reliance Industries Limited3. The Mumbai Tribunal has held that once the computer software is put onto a media and sold, then it becomes like goods and is not a patent or invention. Thus, the payment made for purchase of software is not royalty as the same is a purchase of copyrighted article and not a copyright. In view of different prevalent views in the context of software payments, it seems that the controversy in respect of software payments would continue till the High Court / Apex Court gives its decision. The taxpayers would have to take utmost care at the time of making remittances for software payments. The consequences for not withholding taxes on these payments could be onerous. It is better to tread with care. |

Ruling of Delhi Tribunal:

Ruling of Delhi Tribunal: