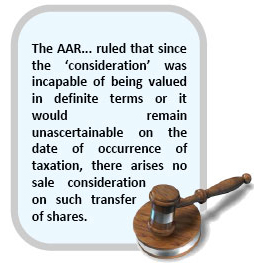

Transfer of shares of a listed Indian company without consideration by a non-resident to another non-resident in the course of corporate group restructuring is not liable to tax in India.

In a recent ruling, the Authority of Advance Rulings (AAR) on an application made by Goodyear Tire and Rubber Company (GTRC ‘transferor’) & Goodyear Orient Company (Private) Limited, Singapore (GOCPL ‘transferee’) ruled that transfer of shares by GTRC to GOCPL of a Indian listed company [Goodyear India Limited (GIL)] without consideration, as part of corporate group restructuring, is not liable to tax in India. The Authority relied upon its earlier ruling in the case of Dana Corporation1 and Amiantit International Holdings Ltd2, in deciding the above case.

The AAR also ruled in the case of GOCPL that, shares of GIL received as a gift will not be considered as income from other sources as per the provisions of the Income Tax Act (‘Act’) as it was receipt of shares of an Indian company in which the public are substantially interested.

Facts of the case:

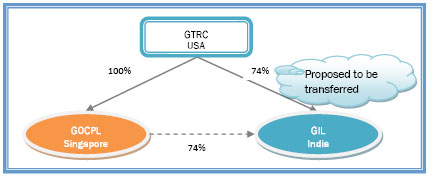

GTRC, incorporated under the laws of USA, holds 74% stake in GIL, an Indian Company listed on the Bombay Stock Exchange.

GOCPL is a wholly owned subsidiary of GTRC. GOCPL is an operating company and manages the worldwide operations of GTRC i.e. natural rubber purchasing, delivery, financing, treasury and quality.

As part of its global corporate strategy and to expand the role of GOCPL for the benefit of its other group entities within Asia-Pacific region, GTRC sought to transfer its entire stake of 74% in GIL to GOCPL without any consideration.

In the background of the above facts, an application was made to the AAR by GTRC as well as GOCPL seeking a ruling on the following questions

- Whether GTRC was liable to capital gains tax in India in relation to the proposed transfer of its shares in GIL to GOCPL, without any consideration?

- Whether GOCPL will be liable to tax in India on receipt of shares of GIL from GTRC, without any consideration?

|

Contentions of the Applicants:

Contentions of the Applicants: