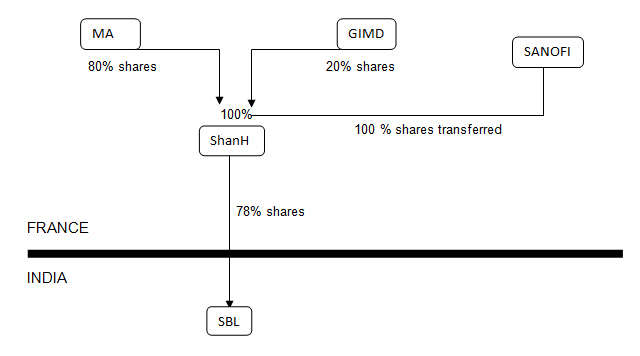

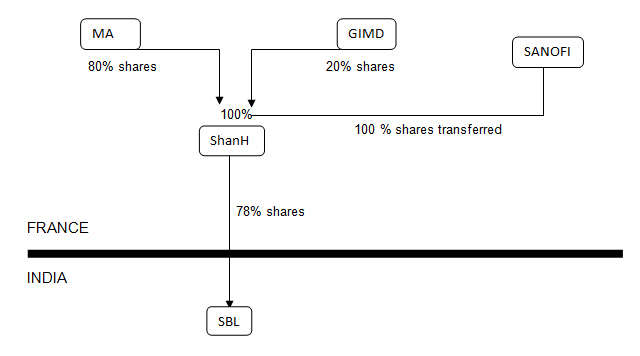

- In 2009, MA and GIMD (collectively referred to as the ‘Sellers’) transferred their entire shareholding in ShanH to Sanofi Pasteur Holding SA (‘Sanofi’), an unrelated French company.

- The above mentioned holding and transaction structure can be diagrammatically represented as under:

- The Sellers paid taxes in France on the capital gains accruing to them by virtue of such sale. It appears that such taxes actually paid in France are in fact higher than those payable in India.

- The Sellers approached the Authority for Advance Rulings (‘AAR’) for a ruling on whether they were liable to tax in India since the transaction under consideration was in essence transfer of shares of ShanH and not the shares of any Indian company.

- In 2011, the AAR held that the transfer of shares of ShanH was a scheme for avoidance of Indian tax and that the capital gains arising from the Transaction was liable for tax in India.

- Aggrieved with the finding of the AAR, the Sellers filed a writ petition before the Court.

Key Issues raised by the Sellers before the Court:

- Whether ShanH lacks commercial substance and is incorporated only for the purpose of avoiding capital gains liability under the Act?

- Whether the corporate veil of ShanH must be lifted and the transaction (of the sale of all ShanH shares held by MA/GIMD to Sanofi) be treated as a sale of SBL shares?

- Whether the transaction is liable to tax in India as per the Act and the

India-France DTAA?

- Whether retrospective amendments to provisions of the Act (by Finance Act, 2012) alter the provisions of the India-France DTAA and/or otherwise render the transaction liable to tax under the provisions of the Act?

Court Ruling on commercial substance and lifting of corporate veil:

Ruling in favour of the Sellers, the Court has held that ShanH was an independent corporate entity registered and resident in France. It had commercial substance and was not incorporated purely for tax avoidance purposes and that the corporate veil of ShanH need not be pierced. In passing this ruling, the Court has laid emphasis upon the following key factors:

- ShanH is an entity of commercial substance distinct from its shareholders and incorporated to serve as an investment vehicle.

- There is no material to conclude that there is a design or stratagem to avoid tax. In fact the demand raised by Indian Revenue authorities in India is lower than actual taxes paid by the Sellers in France.

- As per the correspondences between SBL, ShanH and the Foreign Investment Promotion Board (‘FIPB’), the FIPB has always considered ShanH (and not MA or GIMD) as the shareholder of SBL.

- ShanH has actually contributed to the equity capital of SBL for fresh issue of shares.

- The register of members of SBL reflects the name of ShanH as opposed to MA / GIMD.

- The dividends declared by SBL have been received by ShanH and it does not appear that the same have subsequently been declared to MA and GIMD.

- With regard to the previous acquisition of shares by ShanH from other non-resident shareholders, the tax authorities themselves have considered ShanH as the acquirer of such shares for withholding tax purposes.

- ShanH is neither a mere nominee of MA/GIMD, nor is it a colourable device for tax avoidance.

- There is no evident extraordinary control by MA over the affairs of SBL.

- ShanH continues to exist post sale of shares by MA and GIMD.

Court Ruling on retrospective amendments to the Act vis a vis India-France DTAA:

Ruling in favour of the Sellers, the Court has held that the retrospective amendment to the Act would not alter the non-taxability of capital gains in India under the provisions of the India-France DTAA. In passing this ruling, the Court passed the following key observations:

- The speech of the Finance Minister while amending the tax laws suggests that the amendments do not seek to override the provisions of the DTAA.

- If the intention of the Legislature was that the indirect transfer provisions should override the DTAA, a specific amendment to section 90 of the Act would have been carried out.

Court Ruling on non taxability of the transfer of shares in India as per the India-France DTAA:

Ruling in favour of the Sellers, the Court ruled that the provisions of the India-France DTAA provide that the sale of shares of French Company by French shareholders would typically be taxable in France and not India. Further, a reading of the provisions of the India-France DTAA does not suggest that “look through” provisions exist in transactions not involving immovable property. It was further held that applying look through provisions to the said transaction may result in an absurd and fallible conclusion that there are 2 separate shareholders of the same shares of SBL - Sanofi (as per tax laws) and ShanH (as appearing in the register of members).

Court Ruling on other pertinent aspects

- Basis its ruling on the above aspects, the Court held that Sanofi would not be liable to withhold taxes in India on payments to the Sellers since the transaction was not liable to tax in India.

- Relying on the Supreme Court ruling in the case of Vodafone, the Court also held that controlling interests, being incidental to holding shares in a company, does not constitute a separate capital asset. Even otherwise, the Court held that the capital gains for transfer of such controlling rights cannot be determined since it is incapable of determination and computation.

SKP Comments:

It appears that the Sellers may have approached the AAR to obtain certainty on the tax treatment having regard to the ongoing litigation relating to taxability of indirect transfers in the case of Vodafone.

The Court ruling (the first notable ruling on indirect transfer since the amendment to the Act last year) comes as a ray of hope for the global investor community which would believe that the Supreme Court ruling of Vodafone (of respecting the legal form of transactions and legitimate tax planning measures) has stood the test of retrospective amendments to the Act, albeit with the aid of the DTAA.

Another positive takeaway from this ruling is that the Court would not indiscriminately pierce the corporate veil and the onus would lie on the Indian Revenue authorities to prove that piercing the corporate veil is warranted.

Further, the Court has reiterated that the liability to withhold taxes on payments to non-residents would only apply where such payments constitute income which is taxable in India.

|