The year 2019 has been an eventful year for taxation as well both in India and across the globe. The year witnessed many developments that will have a lasting impact on major businesses and individuals. As we recall some of the significant highlights of the past year, in this section we have summarized the key updates from direct tax, Transfer pricing and indirect tax.

Direct Tax

Reduction in Corporate Tax rates

India has been in the heart of a “growth recession,” which means that the Indian economy is growing at a significantly slow pace. To add fuel to the fire, there is an economic slow down on a global scale. Hence, India has been witnessing a slump in foreign investments, devaluation in Indian rupee, higher unemployment rate, and huge erosion in small and midcap stocks, etc., coupled with India’s GDP dwindling to 5% in the quarter ending June 2019.

To keep the Indian economy afloat, it was imperative that India receives significant foreign investments, on one hand, while generating employment opportunities for the ever growing local population on the other. Accordingly, the Finance Minister, Nirmala Sitharaman, announced some major tax reforms vide Taxation Laws (Amendment) Act, 2019. Some of the significant amendments have been briefly discussed below:

Concessional Corporate Tax rates for all companies

The effective Corporate Tax rate for all companies has been significantly reduced from 34.94% to 25.17% with effect from financial year 2019-20 subject to the following conditions:

- Companies should not avail specified tax incentives/ deductions

- MAT provisions would not be applicable and therefore mat credit set-off won’t be available

- Set-off of any loss related to specified tax incentives/ exemptions not allowed

- One-time option given to companies to opt-in to renew tax regime

- Mandatory surcharge of 10% would apply irrespective of quantum of income

Concessional Corporate Tax rate for new manufacturing companies

The effective Corporate Tax rate for certain manufacturing companies has been further reduced to 17.16% subject to the following conditions:

- Companies should be incorporated on/after 1 October 2019 and production should commence on/before 31 March 2023.

- Companies should be engaged in business of manufacturing or production of article/thing.

- The term “manufacturing” does not cover software development, mining, printing of books or production of cinematograph film or any other business notified by Central Government.

- Other conditions mentioned for concessional Corporate Tax rate for all companies would also apply.

Reduction in MAT rate for companies not opting for concessional tax rates

The MAT rate for companies not availing concessional tax rates would be reduced from existing 18.5% to 15% plus applicable surcharge and cess.

Grandfathering of buyback tax

Buyback tax on buyback undertaken by listed companies has been grandfathered up to 5 July 2019. In other words, buyback tax would be applicable to listed companies only on buyback announcements made after 5 July 2019.

Introduction of tax on super rich (additional surcharge)

Finance Act, 2019 introduced tax on the super rich in the form of additional surcharge as follows:

- Income from INR 20 million – 50 million: 25%, and

- Income > INR 50 million: 37%

- Upon receiving flak from taxpayers at large, especially high net worth individuals and foreign portfolio investors (FPI), additional surcharge on specified capital gains was withdrawn for individuals, HUF, AOP, BOI, artificial juridical person, and FPIs. However, additional surcharge would continue to apply on income other than specified capital gains.

Incentivizing start-ups

India has been leading globally in creating start-up opportunities in the recent years. High Net Worth Individuals (HNIs), overseas venture capitalists, private equity funds, angel investors, etc., have remained very upbeat on the Indian start-up ecosystem. However, since the past few months, start-ups have been receiving income-tax scrutiny notices urging start-ups to pay angel tax, which derives its genesis from section 56(2) (viib) on capital raised from investors. As a result of this, the start-up sector witnessed a steep decline in investments in general.

With a view to boosting the Indian start-up ecosystem, much needed relief was provided in the form of an assurance that additional scrutiny won’t be carried out if the requisite declarations were filed by the start-ups. Further, if any departmental appeal is going on, then the same would be dropped immediately if the matter in appeal is that of explaining source of investments raised by the start-ups.

Faceless E-assessments Scheme, 2019

Previously, the government had introduced the E-Assessment Scheme on 12 September 2019 i.e. assessment proceedings via the electronic mode. However, this was just the first step in reducing the interaction between the taxpayers and the tax officers.

In furtherance to the above, Central Board of Direct Taxes (CBDT) launched the Faceless E-Assessment Scheme 2019 on 7 October 2019. The main thrust behind this initiative was to not only cut off personal meetings but also make it faceless with the objective of bringing in greater transparency and accountability to the scrutiny process.

Salient features of the Faceless E-Assessment Scheme, 2019

Scope of the Scheme

This scheme applies to all assessments under the Act excluding search cases and income escaping assessment (re-assessment).

Structure of the Scheme:

- National e-Assessment Centre (NeAC) shall be set-up in Delhi from where such assessment proceedings would be conducted. The NeAC shall be headed by the Principal Chief Commissioner of Income Tax. At present, NeAC has been recently set up in Delhi on 7 October 2019. Further, approximately, 58,000 cases have been already identified for e-assessment proceedings with the notices already dispatched before 30 September 2019.

- Regional e-Assessment Centres (ReAC) shall be set-up as and when required/ notified by CBDT. At present, 8 ReACs have been set up at Delhi, Mumbai, Chennai, Kolkata Ahmedabad, Pune, Bengaluru and Hyderabad.

- Each ReAC shall have 3 units namely Assessment unit, Review unit, Technical unit and Verification units and each ReAC shall be headed by Chief Commissioner of Income Tax.

Key Benefits of the Scheme:

- Expeditious disposal of cases would be expected

- Increasing standardization and quality management

- Team based assessment with dynamic jurisdiction

Direct Tax Code

Indian tax laws have been drafted 58 years ago with changes proposed every year in the annual budget. Due to language of the current law, there has been a plethora of litigation on varied subjects and also, in order to ensure that the Act covers the newer aspect of doing business and captures true spirit of taxation, there was a dire need to revamp the law in lines with global practices. Accordingly, the Narendra Modi led government appointed a task force to redraft the age-old income tax law and remove ambiguity and align the same with global practices. The task force was required to take into consideration the norms prevalent in other countries, incorporating international best practices while keeping in mind the economic needs of the country.

After a long wait, the task force submitted their report and the new Income Tax Act to the Finance Minister, Ms. Nirmala Sitharaman on 19 August 2019. The key takeaways1 have been briefly discussed below:

- Shorter, crispier and easy to understand

- Possibly big relief to individual taxpayers by revising tax brackets especially for the lower and middle-class income taxpayers

- Reduction in corporate tax rates coupled with phasing out tax incentives

- Tax on repatriation of profits should be done away with

- Backing and further improvising e-assessments

- Carrying out transfer pricing assessments for a block of 4 years

- More focus on resolving tax disputes through mediation/

public ruling seeking clarification from CBDT on any

principle in law

It remains to be seen whether we see any update on this front in Budget 2020. It would be ideal if Government lays down the roadmap for implementation of Direct Tax Code and also provides adequate opportunity to stakeholder to provide their inputs/suggestions on the draft law.

Revised guidelines for compounding of offences

CBDT has issued revised guidelines for compounding of offences under the Act on 17 June 2019 in supersession of previous guidelines which were issued on 23 December 2014. The guidelines are prospective and hence applicable to all compounding applications received on or after 17 June 2019.

While the revised guidelines have provided some major relief to the taxpayers having committed certain offences, which were otherwise punishable under the Act, they have brought in more stringent framework for compounding offences punishable under the Act. The main thrust of the revised guidelines is on the prevention of serious offences under the Black Money Act and Benami Transaction (Prohibition) Act. For instance, offences punishable under section 275A, 275B, and 276 cannot be compounded going forward. Further, many clarificatory amendments have been made, thus putting to rest various interpretational issues in the erstwhile guidelines.

1. Available in public domain through news articles

2. 16 taxmann.com 141 (Pending for adjudication before Supreme Court)

3. 16 taxmann.com 371

India submits final MLI positions to OECD – MLI impact in India from 1 April 2020 onwards

India was actively involved in Organisation for Economic Cooperation and Development’s (OECD) Base Erosion and Profit Shifting (BEPS) project and was also one of the signatories to the Multilateral Instrument (MLI). MLI is a multilateral treaty that enables two or more jurisdictions to swiftly modify their bilateral tax treaties to implement measures designed to better address multinational tax avoidance.

Recently, India submitted its final positions on MLI on 25 June 2019 as a result of which, impact of MLI in India would become visible from 1 April 2020 onwards. Thus, taxability of any international transaction between India and other jurisdiction(s) would have to be evaluated keeping in mind the final positions of all the jurisdictions involved.

Taxation of digital economy

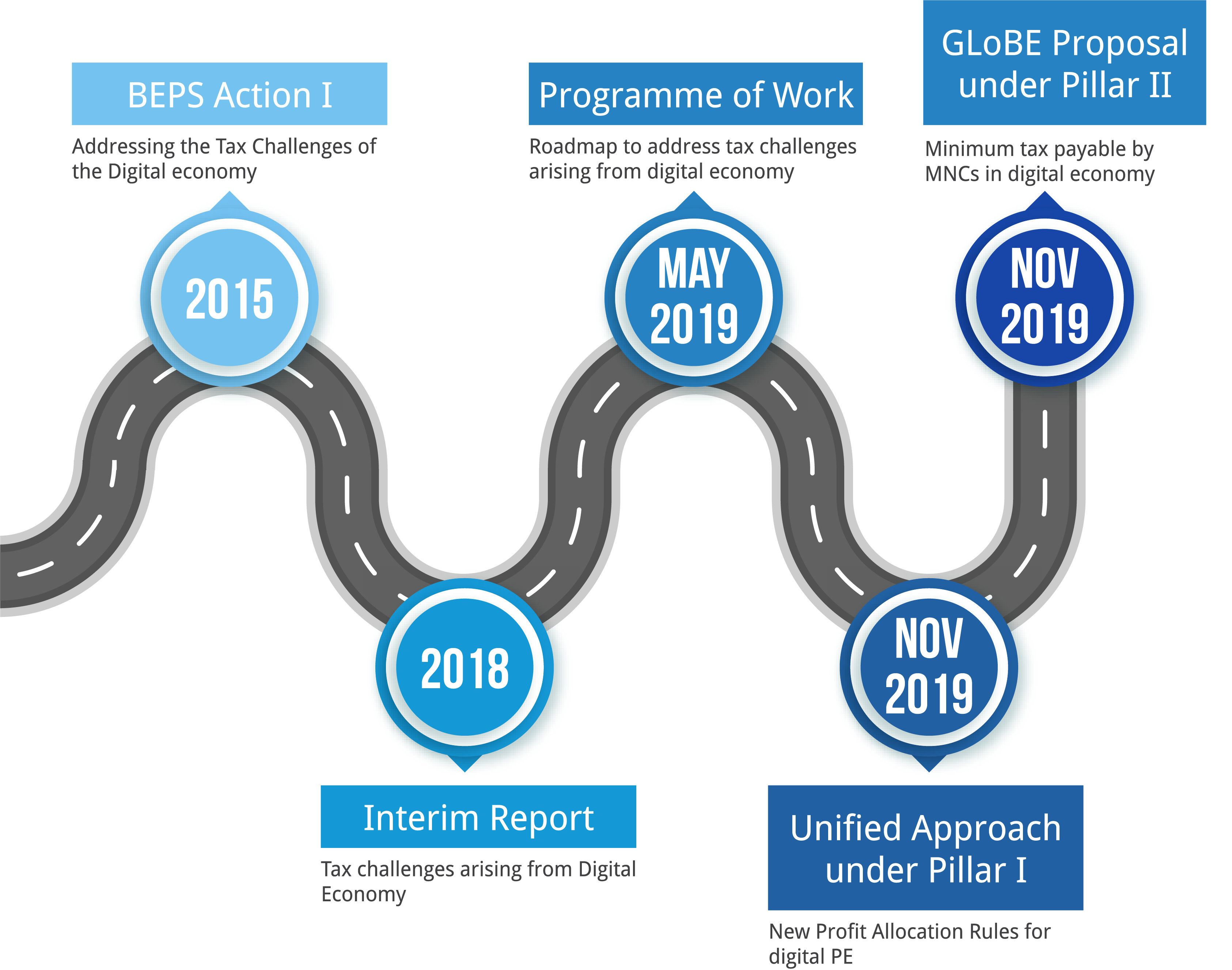

Pursuant to BEPS Action I in 2015 followed by Interim Report in 2018, the OECD released a road map to address tax challenges arising from digital economy in May 2019 with the objective of developing a consensus based solution to the tax challenges arising from a digital economy. The PoW had prescribed two pillars to tackle this menace arising from lack of enabling provisions in tax treaties and/ or the Act to tax digital economy companies.

Pillar I discussed about profit allocation based on nonphysical nexus rules (i.e. Digital Permanent Establishment) while Pillar II discussed about a global anti-base erosion proposal wherein all internationally operating businesses (i.e. multinational companies) would pay a minimum level of tax in the market jurisdiction (i.e. country of source).

In May 2019, the OECD released a public consultation document on “Unified Approach” under Pillar I wherein OECD has laid out guidelines for the determination of digital nexus and the subsequent profit attribution to the digital nexus in an exhaustive manner. Subsequently, in November 2019, the OECD released a public consultation document on “Global Anti-Base Erosion Proposal (GloBE)” under Pillar II which has been designed with the objective of taxing cross border income at minimum tax rates, consistent with the principles of design simplicity, to minimise compliance and administration costs and the risk of double taxation.

India’s revised profit attribution guidelines

Permanent Establishment (PE) and the attribution of profits to a PE is a very complex subject. From an Indian tax standpoint there has been fair amount of litigation on the said issue. Indian tax laws provided some guidance on profit attribution in the form of Rule 10, however the rule was very wide and provided unlimited powers to the tax officer for attributing the profits to a PE in India. Accordingly, there was a dire need to have appropriate attribution rules which provides certainty and removes arbitrary approach followed.

Accordingly, CBDT issued revised profit attribution guidelines in which profits derived from India would have to be calculated basis sales revenue derived by Indian operations from sales in India, number of employees employed in India, wages paid in India and the assets utilised. The approach also provides for a minimum profit attribution of 2% in case where global operations are making loss under the assumption that an Indian business would be profitable and hence India should not be deprived of its fair share of taxes. The approach also covers within its ambit entities having significant economic presence in India.

This approach may pose several challenges for multinationals constituting a PE in India as the standard arm’s length approach based on FAR analysis, which is being followed by most countries across the globe, may no longer be relevant.

Stakeholders have provided their suggestions on the draft law and are awaiting the next steps from the government.

Transfer Pricing

Rationalization/ amendments in Secondary Adjustment provisions

The secondary adjustment provisions in India, ever since its introduction by Finance Act 2017 had left the Indian taxpayers in doubt as to its applicability, practical challenge (giving effect in the books of associated enterprise) and the manner of computation etc. The Finance Act 2019 has resolved anomalies as to applicability of these provisions and moreover, it also provided an option to the taxpayer to make one time settlement (by paying taxes) in lieu of getting repatriation of funds from the overseas associated enterprises.

APA Progress

Indian APA programme continued its impressive progress in the year 2019 as well. Press release by Indian revenue suggested impressive statistics:

- 300 APA’s have already been concluded till October 2019

- APA’s covered complex intra-group arrangements such as marketing intangible, corporate guarantee management fee etc among other routine trade transactions

- Increase in the number of new applications during the year FY 2018-19 (7th year of the programme) also indicates great response to the Indian APA programme

Indirect Tax

As far as GST is concerned, the year 2019 saw the government focusing on plugging tax revenue leakages, streamlining processes and eliminating pain points faced by businesses. We have captured the key developments of the year hereunder.

Rationalization of GST rates on under-construction residential properties

In view of the declining demand in the real-estate sector, the GST rate on residential properties was reduced from the effective rate of 12%/8% with Input Tax Credit (ITC) to 1%/5% without ITC, based on the carpet area and the price of the house.

Important clarifications on sales promotion schemes

The government issued important clarifications in respect of applicability of GST on various sales promotion schemes operated by the businesses. Key clarifications issued were as follows:

Introduction of Kerala Flood Cess

The GST Council provided approval to the state of Kerala to levy a Kerala Flood Cess (KFC), over and above the applicable GST, in view of the losses to the state in wake of heavy floods in August 2018. KFC was implemented in Kerala from 1 August 2019.

Change in order of utilization of ITC

The methodology for utilization of ITC was amended. Under the new system, the ITC of IGST has to be completely exhausted against any liability of IGST, CGST and SGST, before utilizing ITC of CGST and SGST.

Restriction on ITC not appearing in GSTR-2A

In October 2019, the government restricted ITC with respect to invoices not appearing in GSTR-2A to 20% of the ITC with respect to invoices appearing in GSTR-2A. With effect from 1 January 2020, the limit has been further reduced to 10% of ITC in respect of invoices appearing in GSTR-2A.

| Type of Scheme | Applicability of GST | Availability of ITC to supplier | Availability of ITC to recipient |

|---|---|---|---|

|

Free samples

or gifts - For

unrelated

parties

|

Not liable to GST

|

No - under section

17(5)

|

NA

|

|

Free samples

or gifts - For

related parties

or distinct

persons

|

Liable to GST under

Schedule 1

|

Yes - provided the

other conditions are

fulfilled

|

Yes - provided the

other conditions

are fulfilled

|

|

Buy one - get

one offer

|

It is not a free

supply. GST will

be chargeable

on the actual

consideration.

|

Yes - provided the

other conditions are

fulfilled

|

Yes - provided the

other conditions

are fulfilled

|