Direct Tax

I-T department to issue PAN instantly online

The Income-Tax department is set to launch a facility to instantly issue Permanent Account Number (PAN) using details from the Aadhaar database. The electronic PAN (ePAN) facility would be available free of cost and “on a near real-time” basis. Those looking for an ePAN will need to quote their Aadhaar and verify the details using a one-time password (OTP). Most of the basic information required for a PAN application would be easily taken from the database. Once a PAN is generated, the applicant will be issued a digitally signed ePAN, with a QR code which will capture the demographic data besides photo of the applicant. The information in the QR code will be encrypted to prevent forgery.

Sunset clause: Commerce, finance ministries discuss SEZ tax benefit extension

Senior government officials confirmed that the finance ministry is currently assessing the proposal since the revenue department is not in favour of extending the SEZ sunset clause. A final call on the SEZ direct tax benefits extension is yet to be taken and the officials said that it will be taken up once the revenue department begins the budget discussions. Any tax incentive provided by the government lures taxpayers and plays a vital role in an investment decision. In view of the recent reduction of the corporate tax rate and reduction in MAT to 15%, tax arbitrage of SEZ has neutralized. In our view, considering that the government also has to work towards making the existing export benefit schemes compliant with the WTO scheme under FTP 2020-25, foregoing of certain incentives could be a real possibility for exporters including the non-extension of SEZ sunset.

Digital tax on MNCs: India seeks changes in OECD math

India has sought changes in the Organization for Economic Cooperation and Development (OECD) proposal on digital taxation, saying it would deny the country its proper share of taxes from multinationals such as Google, Facebook, Uber, and Netflix, which generate substantial revenues locally. The government has proposed a more balanced principle for the taxation of such companies based on place of revenue generation. The OECD had on October 9 released a draft on taxing digital companies for public comment. Discussions on the proposal are to be held on November 21-22. All countries have to agree for the rules to be enforced.

The proposed OECD formulation will mean India getting little revenue despite the large digital and business presence of companies, the official said. This is because only “residual profit” will be apportioned among the countries where a company has its markets. The government is of the view that multinational companies derive large revenues from countries such as India via their digital presence, without having a physical one, and has questioned the distinction between “routine profits” which accrue due to physical presence and “residual” profit.

CBDT has released APA annual report for FY 2018-19

Advance Pricing Agreement (APA) program was introduced in India more than 7 years ago (in 2012) and currently, it is in 7th annual cycle of examination and processing of applications.

In November 2019, the Central Board of Direct Tax (CBDT) released the 3rd annual report on India’s APA Program for the period 2018-19.

The annual report carries forward the CBDT’s unique initiative of the last two years to bring into the public domain various statistical and qualitative aspects of India’s APA programme. Some of the key highlights are as under:

Important statistics for FY 2018-19

- New applications filed during the year- 170

- Unilateral APA - 123

- Bilateral APA - 47

- Applications signed during the year - 52

- Unilateral APA - 41

- Bilateral APA - 11

Industry-wise bifurcation of signed APA

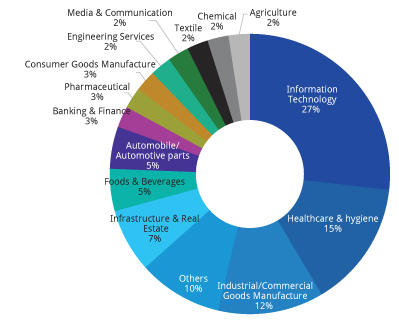

The CBDT has released the industry-wise statistics of signed APA. Notably, the Information Technology and Health & Hygiene industries constitute more than 40% of the signed agreements. Diagrammatic representation is provided as under:

Distribution of Agreements — Industry wise – (2018–19)

Signed Bilateral APA

The CBDT has mentioned that more than 80% of signed bilateral agreements (31) have been signed with 4 countries, i.e., USA, UK, Japan, and Switzerland.

Reasons for reduction in signed APA

While the APA signed in FY 2018-19 has been decreased by 30%, CBDT has clarified the following reasons

- With more and more complex cases coming into the APA Programme, more time is required to analyze the covered international transactions

- The shortage of manpower in the APA teams has continued, which has slowed down the processing of applications.

Indirect Tax

Export benefit such as SEZ, EPCG, MEIS, etc. held to be non-compliant with WTO norms

A World Trade Organization (WTO) panel in its report has ruled that the export promotion schemes viz. Merchandise Export from India Scheme (MEIS), Duty Free Import Scheme (DFIS), Export Oriented Units (EOUs), Electronic Hardware Technology Park (EHTP), Bio-Technology Park (BTP), Special Economic Zone (SEZ), etc. are inconsistent with the agreement on Subsidies and Countervailing Measures (SCM), and accordingly should be withdrawn.

The key schemes considered by the WTO panel and its decision thereon are as follows:

| Sr. No. | Scheme and export benefit therein | Conclusion of the WTO panel | Conclusion of the WTO panel |

|---|---|---|---|

| 01 | Exemption from customs duties under EOU, EHTP, BTP and EPCG schemes | Inconsistent with the SCM agreement | 120 days of the adoption of report |

| 02 | Exemption from customs duties and IGST, and deductions from taxable income under the SEZ scheme | Inconsistent with the SCM agreement | 180 days of the adoption of report |

| 03 | Exemptions from customs duties under conditions 10, 21, 36, 60(ii), 61 of DFIS | Inconsistent with the SCM agreement | 90 days of the adoption of report |

| 04 | Duty Credit Scrips under MEIS | Inconsistent with the SCM agreement | 120 days of the adoption of report |

| 05 | Exemptions from central excise duty on domestically procured goods under EOU, EHTP and BTP schemes | Consistent with the SCM agreement | NA |

| 06 | Exemption from customs duties under conditions 28, 32, 33, 101 of DFIS | Consistent with the SCM agreement | NA |

Government invites suggestion for RoDTEP scheme

Recently, the government had announced its plans to launch the Remission of Duties or Taxes on Export Products (RoDTEP) scheme to replace the existing MEIS and other export promotion schemes.

Now, in order to determine the burden of embedded taxes and formulate incentive rates under the proposed scheme, the Ministry of Commerce and Industry is inviting productwise data/information from manufacturing units/exporters. Following product-wise data should be provided in a format set by the government:

- Details of the exported product;

- Details of common embedded taxes such as transportation, electricity, etc.;

- Details of embedded taxes on raw materials/inputs.

Simplification of GSTR-9 (Annual Return) and GSTR-9C

The government has brought in simplifications to annual return (GSTR-9) and reconciliation statement/audit (GSTR- 9C) FY 2017-18 and FY 2018-19. Some of the key points are captured hereunder –

Changes in GSTR-9 (Annual Return)

- An option to disclose Table 4B to 4E [i.e., B2B supplies, exports/SEZ supplies (with payment of tax), deemed exports] net of credit/debit notes and amendments.

- Exempted, Nil-Rated and Non-GST supplies can be shown entirely in the “exempted supplies” row.

- The break-up of Input Tax Credit (ITC) availed in GSTR- 3B into inputs, input services, and capital goods is made optional.

- The disclosure of HSN wise summary of outward and inward supplies is made optional.

Changes in GSTR-9C (Reconciliation Statement)

- The requirement of reconciliation of sales turnover as per the financials with the annual return is made optional.

- Reconciliation of the ITC availed and the expense wise disclosure of ITC availed is made optional.

The above relaxations have been provided by the government to the taxpayers to ensure that they finalize their GSTR-9 and GSTR-9C return quickly to meet the extended due date of 31 December 2019.

[Notification No. 56/2019-Central Tax dated 14 November 2019]

Communications from the GST department to contain DIN

The government has directed that search authorizations, summons, arrest memos, inspection notices, and letters issued in the course of any inquiry by any officer should contain a computer-generated Document Identification Number (DIN). This should be applicable to documents issued on or after 8 November 2019.

Any communication not bearing the DIN and not covered under certain exceptions should be considered invalid and deemed to have never been issued. The recipient of the communication can ascertain the genuineness of the DIN by using the facility available on https://www.cbicddm.gov.in/ MIS/Home/DINSearch

[Circular No. 122/41/2019 – GST dated 5 November 2019]