|

|||||||||||||||

| Tax Authority’s Eye on Indirect Share Transfers | |||||||||||||||

|

|||||||||||||||

Whether the tax authorities can issue notice under section 201 to determine whether the assessee is under an obligation to withhold tax at source in respect of the said transaction? Whether the tax authorities can issue notice under section 201 to determine whether the assessee is under an obligation to withhold tax at source in respect of the said transaction?

Contentions of the Assessee: The assessee relied on the Bombay High Court’s decision in the case of Vodafone International Holdings BV1 and contended that the transfer of shares in a non-resident company by one non-resident company does not amount to acquisition of immovable property or control of the management of that other company and it is only an incident of ownership of the shares in a company which flows out of the holding of shares. Further, it was argued that controlling interest is not an identifiable or distinct capital asset independent of the holding of shares and the nature of transaction has to be ascertained from the covenants of the contract and from the surrounding circumstances. In view of the above, it was contended that no capital gains tax had arisen in India since there was no capital asset in the form of controlling interest. Contentions of the Tax Authorities: The tax authorities argued that the shares held by Finsider in Sesa Goa constituted a capital asset and hence, when the shares of Finsider were purchased by the assessee, the said transaction amounted to a transfer of capital asset in the form of 51% shares of Sesa Goa. Further, as per section 195 of the Act, any person making payment to a non-resident is liable to withhold tax at source and in the instant case, the assessee fell within the definition of any person. Hence there was a withholding tax obligation on the assessee in respect of the said transaction. Reliance was placed on the Apex court’s decision in the case of Vodafone International Holdings BV2 where it was held that where a non-resident company acquired shares of another non-resident company which held 67% shares in an Indian Company and show cause notice was issued to the assessee in default for failure to deduct tax at source while making payment, it is for the petitioner to go before the assessing authorities to clarify for default in not withholding tax at source while making payment. Applying the Apex Court’s decision in the instant case, it was argued that the writ petition should be dismissed. Held by the High Court: Mere filing of agreements may not be sufficient to prove that there is no transfer of capital asset and if necessary, the tax authorities may lift the corporate veil to look into the real nature of transaction to ascertain the facts. The tax authorities should also ascertain whether as a majority shareholder, the assessee enjoyed power by way of interest in the assets of the company and

whether transfer of shares includes indirect transfer of assets and interest in the company. Our Comments The said order would open the gates for the tax authorities to scrutinize cross border transactions of two or more non-residents involving transfer of shares of Indian companies. Therefore, foreign companies need to be careful while planning acquisition of shares of holding companies outside India particularly if such holding companies hold shares of valuable Indian companies. |

|||||||||||||||

| Notes: | |||||||||||||||

| 1 Vodafone International Holdings BV v. Union of India (329 ITR 126) (Bom) 2 Vodafone International Holdings BV v. Union of India (179 Taxman 129) (SC) |

|||||||||||||||

|

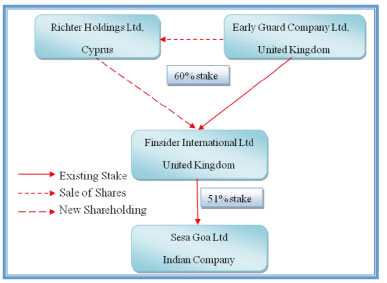

In view of the change in shareholding of Finsider which, in turn, was holding 51% shares in Sesa Goa, the tax authorities in India issued notice under section 201 of the Income Tax Act (Act) to the assessee to show cause why no tax has been withheld from the capital gains that arose in the hands of Early Guard.

In view of the change in shareholding of Finsider which, in turn, was holding 51% shares in Sesa Goa, the tax authorities in India issued notice under section 201 of the Income Tax Act (Act) to the assessee to show cause why no tax has been withheld from the capital gains that arose in the hands of Early Guard.