- The above also has a direct impact in the procedure of issuing refund to the deductees resulting in a huge effort and loss of time at the department end as well as the deductor end, in mapping the inconsistencies.

Steps taken in the Circular to bridge the above gaps:

- The department has created a common link between the TDS certificate in Form No.16A and Form No.26AS through a facility in the Tax Information Network website, which will enable a deductor to download TDS Certificate in Form No.16A from the TIN website based on the figures reported in the e-TDS statement filed by him.

- As both the Forms will be generated on the basis of figures reported by the deductor in the e-TDS statement filed, the likelihood of mismatch between Form No.16A and Form No. 26AS will be completely eliminated.

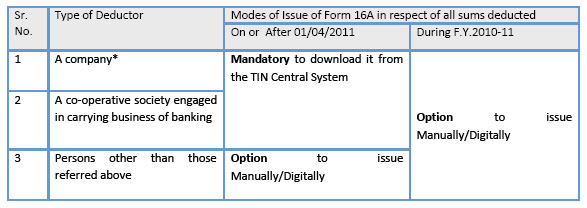

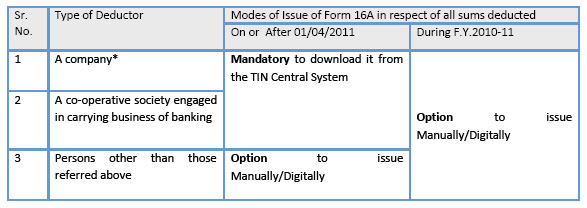

Applicability of the above:

* Including a banking company to which the Banking Regulation Act,1949, applies and any bank or banking institution, referred to in section 51 of that Act. * Including a banking company to which the Banking Regulation Act,1949, applies and any bank or banking institution, referred to in section 51 of that Act.

Any deviation from the above in issuance of the Form 16A shall render it as invalid and will attract penal consequences.

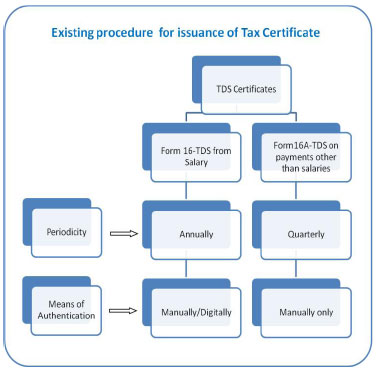

B. Authentication of TDS Certificate :

- Under the existing system since the authentication of TDS certificates in Form 16A was mandatorily required to be done manually, it became a time consuming and long drawn process especially for the deductors who had to issue a large number of certificates.

- The deductors have now been provided with the option of authenticating the certificates digitally, provided the same are downloaded from the TIN central system.

Our Comments

The circular intends to ease the process of issuance of TDS certificates by automating their generation through TIN system, as well as by introducing digital authentication. Thereby, doing away the mismatches and curtailing the numerous correspondences on account of inconsistencies. This will surely be a welcome provision making the deductors more vigilant and responsible in filing the correct particulars in the returns. |

* Including a banking company to which the Banking Regulation Act,1949, applies and any bank or banking institution, referred to in section 51 of that Act.

* Including a banking company to which the Banking Regulation Act,1949, applies and any bank or banking institution, referred to in section 51 of that Act.