Direct Tax

Mauritian Leaks – Another data leak after Paradise Papers and Panama Papers

Post-Swiss Leaks, Panama Papers and Paradise Papers, comes the Mauritian leaks of over 200,000 emails, contracts and bank statements that show how the island nation has been used by corporates to facilitate their partnerships with multinational companies while remitting profits as a foreign direct investment to India without paying any tax on the same. This data leak belongs to a Bahamas based firm called Conyers Dill & Pearman, an offshore specialist firm, having commenced operations way back in the year 1928. The firm started operations in Mauritius in the year 2009 to cater to investments being routed to Africa and Asia.

In the coming days, the investigation would open up more and more Indian names which include the following :

- How Religare Enterprises Ltd. routed funds into a Jersey firm owned by Malvinder Singh and Shivinder Singh

- The deal between Pune based real estate company Kolte-Patil Developers Limited and US based real estate company Portman Holdings LLC wherein Conyers Dill acted as a legal facilitator

- Dealings between a commodity trading giant and Jindal Steel and Power Ltd. relating to ownership of four bulk carrier vessels through a Mauritian company Pancore

- The curious case of iYogi Ltd, Mauritian holding company of its Indian and US operations on its unsuccessful NASDAQ listing in 2011 for whom Conyers was a special legal counsel

- US-based Mayo clinic and its subsidiary used the Mauritian route to enter into a partnership with Apollo Hospitals and GMR to set up a high-end hospital near Hyderabad Airport which subsequently did not take-off

It is to be seen what steps the government would take pursuant to Indian names being revealed in the data and whether this would be yet another smoke screen like Panama and Paradise papers.

Netherlands draft law mandates disclosure of crossborder transactions to tax authorities

On 12 July 2019, Netherlands published a draft legislative proposal which requires all intermediaries and taxpayers in some cases, to report cross-border arrangements that meet certain thresholds to the EU tax authorities. The term “intermediaries” has been defined as any person that designs, markets, organizes, or makes available for implementation or manages the implementation of a reportable cross-border arrangement. Cross-border arrangements with certain thresholds are reportable if main, or one of the main benefits is obtaining a tax advantage.

The information obtained by the Dutch tax authorities is automatically exchanged with other EU member states. This legislation enters into force in its entirety on 1 July 2020 but applies to any and all reportable cross-border arrangements implemented between 25 June 2018, and 30 June 2020. The deadline for reporting is 31 August 2020.

Inclusive Framework on BEPS – Tax laws of 12 low-tax countries not harmful for other countries

Recently, the OECD announced that 12 low/ nil tax countries do not have harmful tax regimes. These countries are Anguilla, the Bahamas, Bahrain, Barbados, Bermuda, British Virgin Islands, Cayman Islands, Guernsey, Isle of Man, Jersey, Turks and Caicos Islands.

For a country to be labeled as not having harmful tax regime, it must meet a substantial activities standard as determined by the Forum of Harmful Tax Practices (FHTP). The standard requires that for certain highly mobile sectors of business activity other than Intellectual Property (IP), the core incomegenerating activities must be conducted with qualified employees and operating expenditure in the jurisdiction. For IP, the standard requires that already agreed “nexus” rules are complied with.

Transfer Pricing

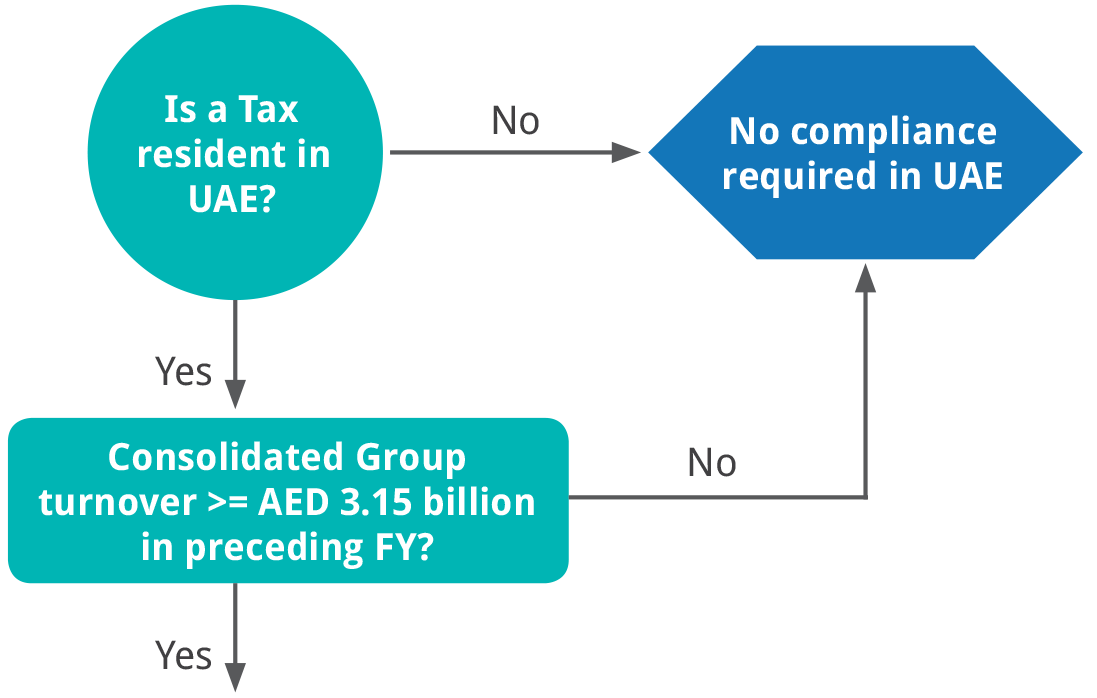

United Arab Emirates | Country-by-Country Reporting requirements introduced

The United Arab Emirates (‘UAE’) has introduced countryby- country (‘CbC’) reporting requirements in its jurisdiction effective from financial reporting period beginning 1 January 2019 - following its 2 neighbouring Gulf Cooperation Council (‘GCC’) member states i.e. Saudi Arabia and Qatar. The chart below depicts the applicability and compliance requirements for CbCR :

Notify the UAE Ministry of Finance before the end of the financial reporting year of the MNE:

- Whether it is ultimate parent entity or surrogate parent entity? OR

- The identity and tax jurisdiction of the enterprise that will be submitting the CbC report.

- a. In cases where the UAE based entity is the Ultimate parent entity of the MNE group or is serving as a surrogate parent entity of the MNE group: The CbC report, which is mostly in line with the guidance issued by the OECD in terms of the content and format) must be filed within 12 months from the end of the financial reporting year of the MNE group. For eg: If the financial reporting period begins 1 January 2019 and ending on 31 December 2019, then the CbC filing due date would be 31 December 2020.

- b. In cases where the UAE based entity is a part of an MNE group whose Ultimate parent entity/reporting entity is incorporated outside UAE: The UAE entity would be required to notify the UAE Ministry of Finance about the identity and tax jurisdiction of the enterprise that will be submitting the CbC report. The notification is to be submitted before the end of the financial reporting year of the MNE group.

Failure to comply with the CbC rules may result in the imposition of penalties.

Czech Republic | Amendment to transfer pricing guidelines

The General Financial Directorate (GFD) published Instruction D-034, which replaces the existing Instruction D-332 in relation to the transaction between associated enterprises, following the OECD TP guidelines. The New Instruction D034 addresses the following major issues, among others :

- Any business relationship between related parties; including a parent company’s instruction resulting in a taxpayer’s loss, will be considered a related-party transaction.

- Arm’s length principle, benchmarking analyses and factors determining comparability recommendations, comparative analysis, description of methods to determine transfer prices and their use in practice, etc.

- The basis for application of the arm’s length principles is the comparison of conditions in a related-party transaction to those in an unrelated (independent) transaction.

- Special attention is given to the value chain and to risk and functional analysis in determining the profile of the enterprise under review, and subsequently the distribution of profits depending on where in the chain of enterprises, the value is created.

- The instruction also includes detailed recommendations on preparing comparative analyses (to be prepared every three years), while a review of the independence and profitability of selected unrelated enterprises would be on an annual basis. Multiple-year data (for three to five years) would be used to determine market ranges.

Poland | Issues guidance on transfer pricing comparability for multinationals

Poland’s Ministry of Finance recently released an explanatory note addressing transfer pricing comparability analyses. This is applicable to comparability analyses for transactions between related parties conducted until the end of 2018. The key highlights of the guidance are as under :

- Selection of appropriate comparables: Referring to the OECD transfer pricing guidelines, the Polish Ministry states that the comparables can be local, regional, or global, which should be decided on the basis of all comparability factors, including proper identification of a suitable market. While the guidance states that the use of comparables from other regions is accepted, Polish market comparables shouldn’t be artificially excluded or omitted in the selection process. Use of secret comparables is strictly not allowed. Selection of proper comparables requires taking into consideration the quantity and quality of comparables, priority being the quality. Data from entities with ongoing losses or extraordinary profitability are not comparable with entities that have a limited risk profile.

- Approach in case of Inadequate comparables: In case satisfactory results are not achieved in terms of adequate comparables, taxpayers can prepare an arm’s length compliance description of the transaction. In such case, the taxpayer must prove that controlled transaction conditions meet arm’s length principle in another way than by use of comparables, Eg: Commercial rationality. The taxpayer may include expert opinion, market analyses, proper application of valuation technics, and options realistically available in its analyses.

- Use of Interquartile Range for lower level of comparability: When comparables have a lower level of comparability, it is feasible to use interquartile range. All comparables from the range should be of equal value. If significant discrepancies in the range are identified, then the median or arithmetic average or weighted average should be vital. The order of priority, however, is not addressed in the guidance.

- Use of Associated Company Data: If it is not possible to prepare the compliance description, taxpayers can use data from associated companies. Such an approach is not fully aligned with the OECD transfer pricing guidelines. The ministry states that taxpayers should prove that data of the controlled transaction between associated companies are not affected by associated companies (as an example, if there is a formal association even though no transaction with the associated company). While this is not fully aligned with the OECD transfer pricing guidelines, such an approach would be difficult to prove thereby paving way for triggering a litigation.

Indirect Tax

France approves Digital Services Tax on tech giants

[Excerpts from BBC.com]

France has approved a Digital Services Tax of 3% on multinational firms headquartered outside the country. Digital companies with revenue of more than EUR 750 million, of which at least EUR 25 million is generated in France, would be subject to the levy of Digital Services Tax which will be retroactively applied from early 2019.